Addressing Money Laundering in the Art Market: A Trade Perspective on Challenges and Regulatory Reform

Money laundering legislation remains a significant challenge in a wide range of sectors, and the art market is no exception. While it is imperative to combat money laundering, it is crucial to ensure that measures to address illicit activity do not inadvertently harm legitimate businesses. The art market plays an important role in cultural exchange, economic development, and the preservation of heritage, and thus, regulations must be both effective and proportionate.

This paper outlines the art trade’s perspective on money laundering, highlighting four critical issues: the trade’s commitment to combating illicit transactions, the lack of reliable data on money laundering in the art market, the need for proportionate regulation, and the unjustified expansion of European Union (EU) Anti-Money Laundering (AML) regulations from works of art to all cultural goods. The paper concludes with five practical suggestions to improve the regulatory framework, ensuring that measures are balanced, fair, and based on solid evidence.

Four Critical Points

1. The Commitment of the Art Market to Combat Illicit Transactions

The art trade has long been committed to ensuring that transactions in art and cultural goods are lawful, transparent, and in line with international standards. CINOA represents over 5,000 art dealers, galleries, and auction houses worldwide, all of whom are deeply invested in safeguarding their reputations and adhering to ethical standards. Art dealers are subject to multiple levels of oversight, from banks and financial institutions to legal advisors and accounting compliance teams.

The trade is proactive in ensuring that artwork provenance is verified, buyers’ identities are checked, and that suspicious activities are reported according to international regulations. Not only is this done to comply with the law, but it is also in the interests of the trade from a reputational perspective. Reputation in our sector is of key importance, since many purchasers will have only a limited knowledge of cultural property and know that they are relying on the experience, knowledge and integrity of the seller.

CINOA and its members strive for a lawful, vibrant art market that serves not only as an economic engine but also as a platform for cultural exchange. Members are fully invested in preventing the misuse of art for illicit purposes. It is crucial that regulators recognize the robust compliance frameworks already in place within the sector and the industry’s commitment to self-regulation. However, over-regulation may stifle the diversity of the market and create unnecessary burdens on legitimate dealers, particularly smaller businesses.

2. The Lack of Reliable Data on Money Laundering in the Art Market

One of the most pressing concerns when considering the extent of money laundering in the art market is the lack of reliable, empirical data. The perception that the art market is a haven for illicit activity, particularly due to its high-value nature and secrecy, has been overstated. As highlighted by experts like Dr. Umut Turksen, the art market is often perceived as highly vulnerable to abuse. However, this perception is frequently exaggerated and does not reflect the reality of most transactions, which are tracked and recorded. Most transactions involve relatively low monetary values and are well-documented. Auction sales and gallery exhibitions are publicly recorded, and dealer transactions are meticulously documented and accessible for inspection or auditing by relevant authorities.

Moreover, data about the scale of money laundering in the art market is speculative at best. Reports on the topic often rely on anecdotal evidence or isolated instances of proven money laundering, which represent a tiny fraction of the overall market. According to the U.S. Department of the Treasury’s 2022 investigation, the art market, with its unique characteristics, is a poor vehicle for money laundering. Cultural goods are unique, easily identifiable and not very liquid. Despite this, the notion that the art market is particularly susceptible to money laundering persists, often without substantial evidence.

Dr. Anna Mosna’s term “art laundering”—referring to the funneling of illicit cultural goods into the legitimate market—highlights a relevant issue but one that is more specifically concerned with trade in stolen or illegally exported property. These practices are already addressed by existing laws governing stolen goods and illegal exports and should not be conflated with AML regulations, as doing so would unnecessarily blur the distinctions between different types of criminal offenses.

3. The Need for Proportionate and Targeted Regulation

While AML regulations are crucial for maintaining the integrity of financial markets, they must be proportionate and targeted when applied to non-financial sectors. Dr. Saskia Hufnagel aptly pointed out that it is critical to balance the need for effective deterrents with the financial burden these regulations place on businesses, particularly small art dealers with fewer than three employees.

The current wave of EU AML legislation has already imposed significant restrictions on cash transactions in the art market. From 2027, transactions over €10,000 will be prohibited in cash, a measure already implemented in many jurisdictions. This aligns with global standards, but the art market has already taken significant strides to implement due diligence and prevent illicit financial activities. Already it is the case that transactions often involve multiple levels of gatekeepers, such as banks, legal advisors, accountants, and auditors. Established art dealers are committed to protecting their businesses and reputations from criminal activities, but smaller players in the market—often family-run galleries or independent dealers—are disproportionately affected by these stringent regulations and believe that those other gatekeepers are better placed to carry out checks.

A particular concern is the growing trend of ‘debanking’ in the art market. Debanking refers to the practice where financial institutions withdraw banking services from certain clients, in this case, art dealers, due to the perceived risks associated with the industry. Financial institutions, wary of the perceived risk of art transactions—especially in light of the EU’s and other countries’ blanket “high-risk” rating for the art sector—are closing accounts or refusing to offer services to legitimate art dealers. This has led to smaller dealers being forced out of the banking system altogether, further burdening the smallest players in the market. Such actions are counterproductive, as they penalize businesses that are already complying with regulations and doing their part to prevent illicit transactions.

As Dr. Hufnagel notes, over-regulation or poorly designed laws could result in the criminal prosecution of art dealers for routine business transactions, exacerbating the challenges faced by the smallest businesses. More targeted, proportionate regulations would better address actual risks without strangling the diversity that exists in the market.

4. Expansion of EU Regulation: Unjustified and Misaligned

In 2027, the EU is set to expand its AML regulations to cover all cultural goods including works of art, antiques, and cultural artifacts. This expansion has been justified by an aim to harmonize regulation across EU member states, but the lack of empirical evidence linking these goods to money laundering risks makes this expansion unjustified. The European Commission has not provided compelling data to demonstrate that these goods—such as antique furniture—pose a significant risk for money laundering.

The U.S. Department of the Treasury’s investigation into the art market found that the high-value art market is a poor vehicle for laundering illicit cash proceeds, largely due to its public transparency and traceability. The investigation also concluded that other sectors, such as luxury goods and high-end fashion, present a greater risk for laundering, yet these sectors have been largely excluded from AML regulations. The art market, on the other hand, has been disproportionately targeted without sufficient evidence linking it to widespread money laundering activities.

The expansion of EU AML obligations to all cultural goods raises concerns about fairness and consistency. If the goal is to combat money laundering in high-value transactions, it would make more sense to focus on sectors with clear evidence of illicit activity. Furthermore, the exclusion of other high-risk sectors, such as luxury goods or vintage wine, undermines the fairness of the regulation. Why should art, antiques, and cultural goods be singled out while other luxury markets continue to operate without the same scrutiny?

Conclusion: A Call for Evidence-Based and Fair Regulation

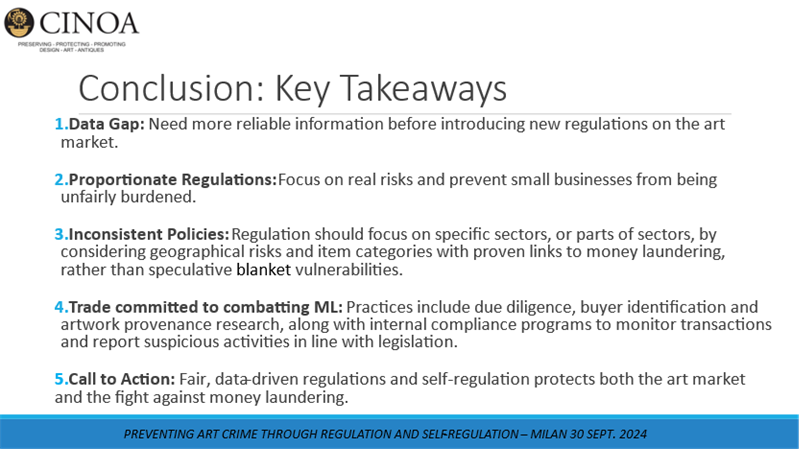

In conclusion, the art market is committed to transparency, self-regulation, and adherence to international AML standards. However, the ongoing expansion of AML regulations in the EU and other regions threatens to undermine the diversity and sustainability of the sector. As this paper has outlined, key issues include:

- A Data Gap- The Lack of Reliable Data: There is insufficient empirical evidence to justify the sweeping claims about the prevalence of money laundering in the art market. Exaggerations can lead to ineffective policies that fail to address real problems.

- Proportionate and Targeted Regulation: Regulations should target real risks and not burden small, legitimate businesses. Over-regulation can harm smaller players in the art trade, shifting the market toward large corporations away from micro enterprises whose hallmarks often include diversity and creativity.

- Inconsistent policies/Unwarranted Expansion of EU Regulation: The EU’s decision to expand AML regulations from works of art to all cultural goods is unjustified. Existing data and studies point to luxury goods as a greater risk for money laundering, yet these are largely excluded from regulation. The expansion should be based on clear evidence and a focused approach.

- Trade Commitment to Compliance: The art trade has implemented robust compliance measures to combat money laundering. Art dealers are committed to ensuring that their transactions are legitimate, transparent, and compliant with international standards.

- Call to Action- Fair Policymaking: Policymakers must ensure that regulations are fair, focused on actual risks, and based on solid evidence. Regulatory measures should be designed to address proven vulnerabilities rather than speculative or generalized risks.

The future of the art market depends on achieving a balance between protecting the market from illicit activities and maintaining an open, diverse, and thriving industry. We urge policymakers to adopt evidence-based regulations that do not overburden the art market but instead promote transparency, fairness, and effective deterrence of criminal activities.

References

- European Union Anti-Money Laundering Legislation.

- U.S. Department of Treasury, 2022 Report on Money Laundering in the Art Market.

- Dr. Anna Mosna, “Art Laundering: The Channeling of Illegally Sourced Cultural Goods.”

- Dr. Saskia Hufnagel, “Regulatory Impacts on Small Art Businesses.”

CINOA’s input for the International Conference on Preventing Art Crime through Regulation and Self-regulation held in Milan 30, 2024. The conference is part of the activities of the UNESCO Chair Business Integrity and Crime Prevention in Art and Antiquities Market and is co-organised and sponsored by the CNPDS Foundation – Centro Nazionale di Difesa e Prevenzione Sociale of Milan.